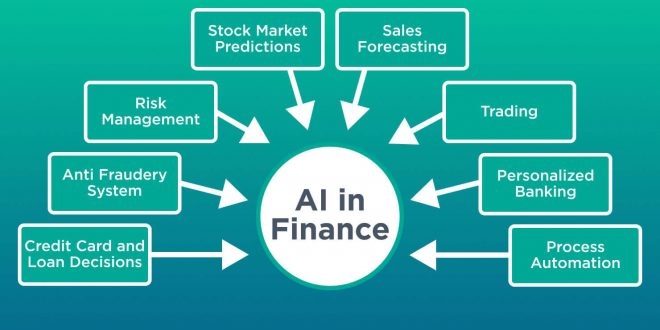

Artificial Intelligence (AI) is reshaping the landscape of financial services, ushering in a new era of efficiency, personalization, and innovation. This article explores the transformative role of AI in the banking sector and the diverse applications that are driving significant advancements in financial technology.

- AI-Powered Customer Service: AI-driven chatbots and virtual assistants are enhancing customer service in banking, providing instant support, answering queries, and facilitating seamless interactions around the clock.

- Personalized Banking Solutions: AI algorithms analyze customer data to offer personalized financial solutions, such as tailored investment advice, customized budgeting plans, and suitable loan options.

- Fraud Detection and Risk Management: AI’s ability to detect patterns and anomalies in real-time data enables banks to strengthen their fraud detection capabilities and enhance risk management protocols.

- Robo-Advisors and Wealth Management: Robo-advisors powered by AI algorithms offer automated and cost-effective wealth management services, making investment advice and portfolio management accessible to a broader audience.

- Credit Scoring and Loan Approvals: AI-driven credit scoring models assess creditworthiness more accurately, leading to faster and more efficient loan approvals, especially for underserved populations.

- Predictive Analytics and Market Insights: AI-based predictive analytics help financial institutions anticipate market trends, assess investment risks, and make data-driven decisions for better performance.

- Automated Compliance and Regulatory Reporting: AI streamlines compliance processes, ensuring banks adhere to ever-evolving regulations and automating complex reporting tasks for regulatory authorities.

- Natural Language Processing in Banking: AI’s natural language processing capabilities enable banks to process unstructured data from customer interactions, emails, and documents to extract valuable insights.

- Smart Contracts and Decentralized Finance (DeFi): AI integration with blockchain technology facilitates the execution of smart contracts in DeFi platforms, automating financial transactions without intermediaries.

- Ethical AI in Finance: Ensuring ethical AI practices in finance is crucial, addressing issues of bias, privacy, and transparency to build trust and foster responsible AI adoption.

Artificial Intelligence is propelling the financial services industry into a new era of efficiency and customer-centricity. By harnessing the power of AI-driven solutions, banks can optimize operations, offer personalized services, and stay ahead of the competition in an increasingly digital world. Embracing ethical AI practices and maintaining a focus on customer needs will be the key to revolutionizing the future of banking and redefining the way financial services are delivered and experienced.

Blogmado Empower Your Wealth: Expert Insights for Success

Blogmado Empower Your Wealth: Expert Insights for Success